Get Qualified For A Home Equity Line of Credit Without Impacting Your Credit Score

Your credit score doesn’t have to stop you from getting a home equity line of credit to complete home renovations. Using the patented Passport® system from FormFree®, you can get qualified in minutes. YOUR CREDIT SCORE IS NOT USED TO GENERATE OFFERS.

- Get HELOC Offers Quickly

- Get HELOC Offers Quickly

As Seen In

As Seen In

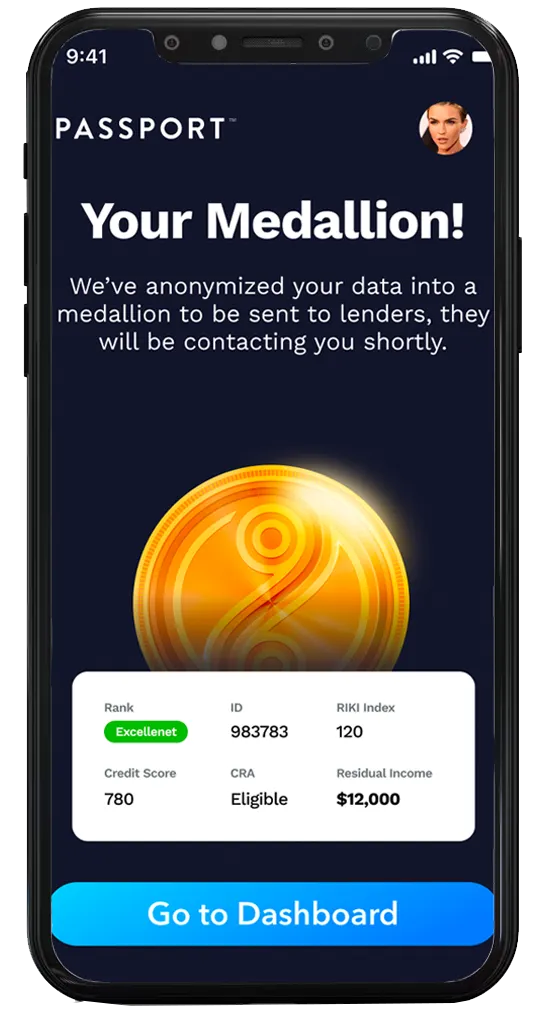

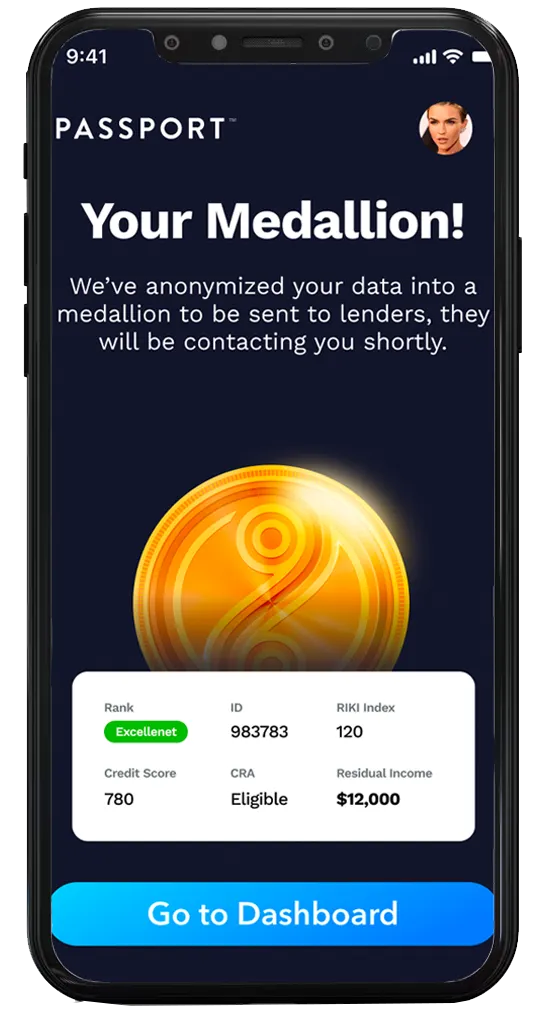

Generate Your Medallion™

Getting Qualified For A Home Equity Line of Credit With Passport Is Simple

*FormFree does not sell your information for marketing campaigns

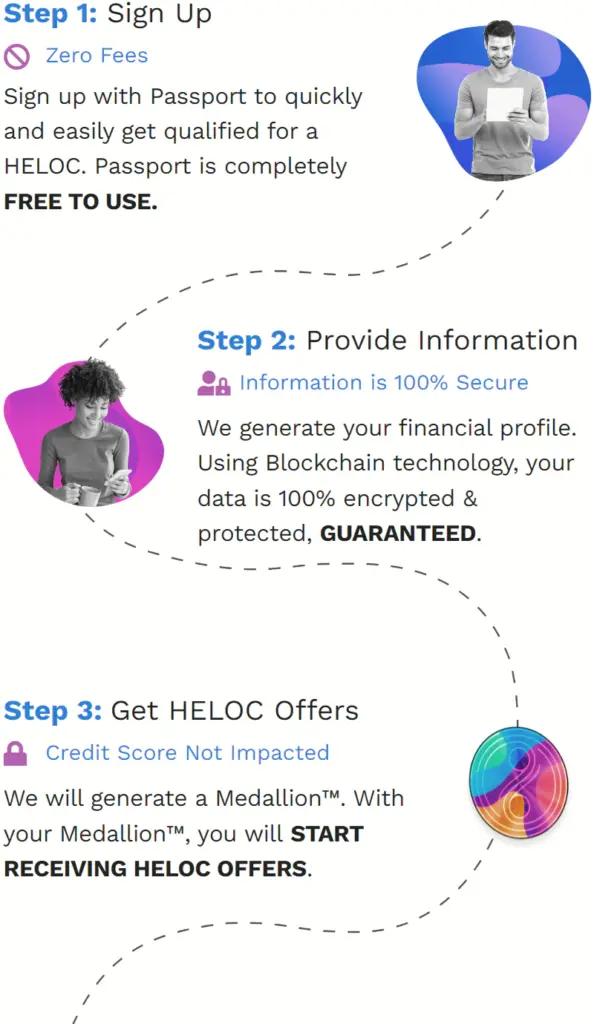

Step 1

Sign Up With Passport

- Zero Fees

Sign up with Passport to quickly and easily get qualified for a HELOC. Passport is completely FREE TO USE.

Step 2

Provide Your Information

- Your Personal Information Is Secure

Enter your information into Passport so we can generate your financial profile. FormFree’s security procedures meet the highest standards of security used by banks. Your data is ALWAYS ENCRYPTED AND PROTECTED.

Step 3

Generate Your Medallion™ And Start Receiving HELOC Offers

- Get Access To A HELOC. Credit Score Not Impacted

Using your financial information, Passport generates your Medallion, showing lenders your borrowing power. Using your Medallion, PASSPORT HELPS GENERATE HELOC OFFERS for you and only shares your personal information once you have accepted an offer.

Less Discrimination=More Opportunities

We Are Here To Fix The Broken HELOC Industry

After being denied for a HELOC based on her credit score, Kiara used Passport to secure a HELOC and make her dream home renovations.”

“I did everything I could to get a HELOC, but my credit score is poor. I used Passport and got the home equity line of credit I needed to get my dream home.”

Passport Removes Human Bias And Creates A Secure Environment

Click “Get Started” to sign up and begin the process. It’s FREE to use.

RIKI™ Score (Residual Income Knowledge Index)

RIKI™ Score

(Residual Income Knowledge Index)

Using your banking data, we are able to help you determine your ability to pay and borrowing power, generating a RIKI Score and eliminating the need for a credit score

RIKI stands for Residual Income Knowledge Index, FormFree’s patent-pending measure of Ability-to-Pay (ATP®) based on income and spending.

Regardless of your race, gender, age or socioeconomic status, we can determine how much you can afford to borrow based on your income and expenses.

By analyzing your banking data, we provide lenders with a more complete picture of your financial situation than that provided by your credit score.

Ability To Pay (ATP)

Your RIKI score demonstrates your ability to pay.

Lower Interest Rates

Your RIKI score provides lenders with more information than just your credit score, leading to lower interest rates.

Get A Loan For Anything

After determining your RIKI Score and your ability to pay, you will be able to qualify for a HELOC.

Your Questions Answered

Your Questions Answered

Check out our most common questions and get the answers you need.

Do I need to have a good credit score?

No! Your credit score has no impact on your ability to pay or your ability to generate HELOC offers with Passport. Simply go through the application process, upload your financial data by connecting your bank accounts and Passport will generate your Medallion.

Will my credit score be impacted by signing up?

No! Going through the signup process has ZERO impact on your credit score. In fact, you don’t even have to have a credit score to use Passport to get qualified for HELOC offers. We do not use your credit score to analyze your ability to pay for a HELOC.

Is this secure? I am nervous about uploading my info.

Your data is always encrypted and protected. FormFree’s security procedures meet the highest standards of security used by banks.

How quickly will I qualify for a HELOC?

After completing the signup process, providing your banking information, and generating your Medallion, you will begin to receive offers from lenders in a few hours.

If you don't use my credit score, what do you use?

We have developed a proprietary tool called RIKI that determines your Ability To Pay (ATP) for loans. This gives lenders a better understanding of your financial situation and allows you to acquire a HELOC with a poor credit score or even without one.

Check out our most common questions and get the answers you need.

No! Your credit score has no impact on your ability to pay or your ability to generate HELOC offers with Passport. Simply go through the application process, upload your financial data by connecting your bank accounts and Passport will generate your Medallion.

No! Going through the signup process has ZERO impact on your credit score. In fact, you don’t even have to have a credit score to use Passport to get qualified for a HELOC. We do not use your credit score to analyze your ability to pay for a HELOC.

Your data is always encrypted and protected. FormFree’s security procedures meet the highest standards of security used by banks.

After completing the signup process, providing your banking information, and generating your Medallion, you will begin to receive offers from lenders in a few hours.

We have developed a proprietary tool called RIKI that determines your Ability To Pay (ATP) for loans. This gives lenders a better understanding of your financial situation and allows you to acquire a HELOC with a poor credit score or even without one.

Get Qualified For A HELOC Today

- Credit Score Not Used To Generate Loan Offers

Explore the Passport application process today for FREE and start getting qualified for HELOC offers. Your credit score is not used to generate HELOC offers.